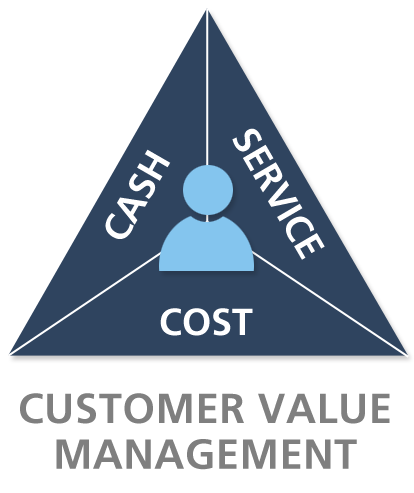

CUSTOMER VALUE MANAGEMENT

End to end approach driving cashflow, cost reduction and boosting customer retention

The Customer Value Group (CVG) has one overriding objective – to generate maximum value for its clients from their relationships with their customers in terms of cashflow, profitability and the service they provide. Our approach has succeeded in integrating the disparate worlds of Accounts Receivable (AR) and Sales, liberating hitherto unrealised financial benefits for Global 2000 clients and large F&A BPO providers.

CVG implements best-in-breed software and services which focus on the automation of credit, collections and customer query/dispute management. Recent CVG clients have delivered huge reductions in AR by collecting cash more effectively whilst also, surprisingly, enhancing service levels through better communication and faster resolution of key customer issues. We call this Customer Value Management (CVM).

At The Customer Value Group our ethos is to grow as a result of our clients’ growth, as they realise their commercial goals. Where we differ from traditional consultancies is our offer of the speed, value and innovation benefits provided by leading-edge software solutions. Where we differ from the typical software vendor is in providing the sustainable, sympathetic programmes which clients would expect from seasoned experts in business process transformation. The positive effect of Customer Value Group lives on long after the team has left the building.

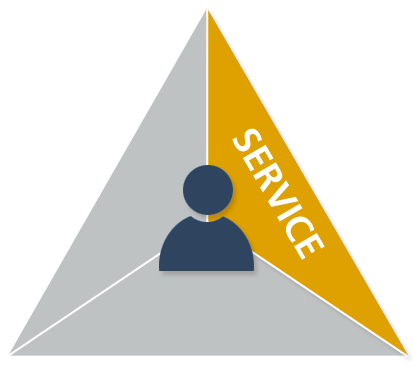

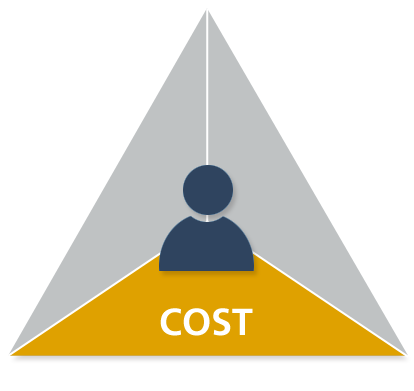

The Customer Value Management universe is centred around making customer relationships as profitable as possible. To achieve this, our holistic solution approach targets cost, cash and service – treating each as a symbiotic, inter-dependent piece of the CVM benefits jigsaw.

Driving down sales and administration costs

Customer Value Group’s approach focuses on key cost drivers in the invoice-to-cash process. By deploying leading-edge processes, activity management and workflow technologies in the credit, collections and customer service areas, our clients can identify customer service issues early, reduce administrative error rates, streamline and automate complex manual processes and reduce interest expenses by converting uncollectible AR into cash.

Accelerating the invoice-to cash cycle and maximising cashflow

Through the management of credit risk, appropriate segmentation of customers and selective automation and management of collection activities, The Customer Value Group’s clients are more effective at collecting cash against outstanding invoices.

Our approach identifies and automates the resolution of customer service issues early to ensure that collection cycle times are reduced and AR/cash conversion is accelerated.

Enhancing customer satisfaction, loyalty and retention

The Customer Value Group’s solutions bridge the gap between traditional customer service software and financial best-practice credit and AR collections. The convergence of these two areas in one unique solution enables our clients to focus on processing customer service items and manage credit and AR collections using just one system. In addition, our clients measure the cost of customer service and can evaluate which customers to focus their valuable resources on.