TARGETING AND TARGET MANAGEMENT

The AR Manager’s conundrum:

Hard to concentrate on targets when manually extracting data on:

- Staff performance

- Portfolio performance

- Credit policies

Should be spending time on:

- Developing and mentoring staff

- Motivating staff

- Managing by exception

- Solving problems

- Reporting automatically both up and down

Solutions inside Value+

Segmenting Customers

Segmentation of total customer base by key criteria such as customer type, size, payment performance, risk level, payment methods.

Automatic and Dynamic Segmentation

Ability to apply timely automatic and dynamic segmentation based on predefined rules, allowing customers to move across segments.

Unlimited Number of Segments

No limitation to number of Segment required.

Strategies by Segment

Automatic application credit, collection and dispute workflow to each segment. Complexity of strategies based on company needs and defined customer segment (for example: High Risk, Low Risk, Big, Medium and Small).

Resource Allocation

Ability to automatic allocate collection resources based on customer segments, number of customers per segment and resources capabilities.

Prioritisation

Automatic generation of prioritised tasks such as reminder letters and telephone calls. The software has the ability to automatically include or omit any transaction types. For example: Disputes, Credit, Debit, Overdue, Current etc.

Action Triggers

The software has the ability to define as an action trigger minimum and maximum transaction value, gaps in days since last action.

Setting Targets

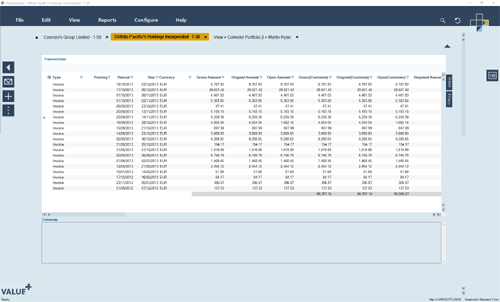

Ability to set Cash Collection targets and monitor performance by Collector, Collector Manager, Customer, Customer Segment, Division and Company

- Cash

- DBO

- DSO

- % age overdue

- % age disputes resolved within SLA