CUSTOMER PAYMENTS AND DEDUCTION MANAGEMENT

Deduction Management

- In some industries (retail, automotive are both examples), there is an agreement in place where the customer can deduct from the payment, stating their reasons

- Deductions are normally an agreed way of working

- A deduction results in an actual transaction being placed into the finance system

- Its typically up to the supplier to disprove the deduction

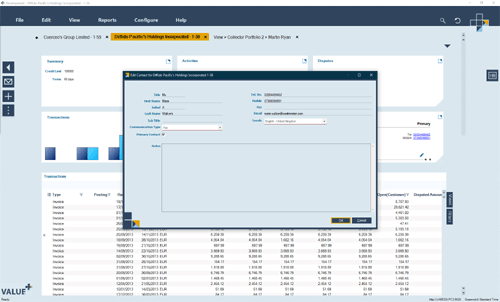

- CVG has built special functionality for this particular purpose called Deduction Management

- Deduction Management deals with any short payments on invoices where a customer does not pay the full amount (for whatever reason)

- As you probably already know, whenever a payment of an invoice is LESS than the invoice amount, most ERPs generate a ‘payment difference’ transaction type for the difference

- CVG Value+ then generates an “Unidentified Deduction task” so collectors can find out more information about why this deduction happened in the first place…

CVG Value+ then supports 3 advanced methods for resolving those unidentified deductions

AUTO-MATCH

CVG Value+ checks if the deduction can be matched to an existing dispute (based on Debit Number and Claim value)

IF match occurs: Upon matching this dispute to the Unidentified Deduction – the Unidentified Deduction is closed and the Dispute gets a tick-box ticked called “Deduction Taken”

PARTIAL

CVG Value+ checks if the deduction can be matched to an existing dispute (based on Debit Number and Claim value)

If NO match occurs BUT other disputes are listed on the account, a list of disputes are provided so the collector can perform a manual match-up. Upon matching this dispute to the Unidentified Deduction – the Unidentified Deduction is closed and the Dispute gets a tick-box ticked “Deduction Taken”

NO MATCH

If a match cannot be made, the Unidentified Deduction can be ‘transformed’ into a dispute by changing the Activity Type…