CREDIT MANAGEMENT

Common issues with Credit Management

Most companies report an issue with credit management in the following ways:-

- Generally across all countries, credit management is handled by the business units in a disparate way where most credit departments very much do their own thing with largely ineffective communication between Credit and Collections

- Credit does not often ask the countries what to set credit limits at or what the payment performance of certain customers is. They might discover this data in reporting but by then it’s often too late

- There is no workflow or ability to track requests for changes to risk codes, credit limits, payment terms. There is also no workflow to warn anyone if a customer or dealer are nearing their credit limit

- Many processes are manual and all done through email

Value+ has funtionality spanning across all of Credit Management as follows…

- Credit scoring and financial analysis

- Risk Management and scoring matrix

- Workflow tracking of credit applications

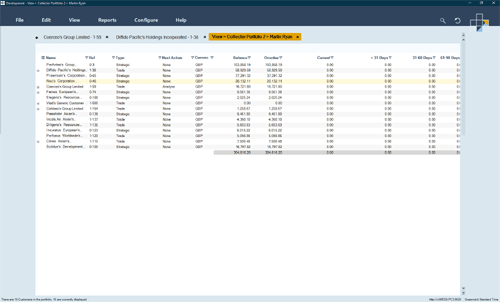

- Credit Portfolio so Credit Managers can manage their customers proactively across all ERPs

- Approvals matrix

- Credit Reporting

- Best practice credit limit algorithm

- Ability to set dynamic credit limit

- Ability to set manual credit limit

- Credit warning to warn collectors and credit managers when customers are about to reach their credit limits

- Credit breach to warn collectors and credit managers when customers have exceeded their credit limits

- Activity request for change of credit information to change credit data about customers

- Credit limit approval

- Credit assessment

- Ability to generate letters to customers (examples below)

- Credit Limit Availability

- Unclaimed Funds Escheatment

- Credit – General Decline

- Credit – Denial per TransUnion

- Open to buy letter (strategy)

- Credit hold and release – Value+ supports a bi-directional feed

- Determine credit quality/manual and auto

- Approval based on credit limit levels

- Quick close statuses

- Super parent credit scoring and limits

- Archiving and credit document repository