GENERATE CASH

“The secret of good cashflow: A happy customer always pays on time”

Accelerating the invoice-to-cash cycle and maximising cashflow

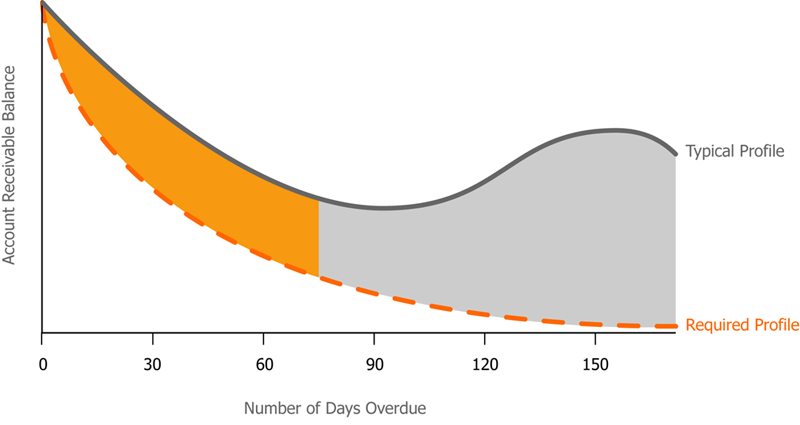

If Accounts Receivable’s processes and systems are in paralysis, an organisation’s ability to manage cashflow is dramatically affected. This can be caused by the existence of multiple systems, lack of workflow behind credit collection, no coherent capability for customer segmentation and dealing with customer service issues, and an inability to monitor performance against targets.

At the core of our solution is the distillation of 30 years’ experience in the invoice-to-cash arena. We can quickly reduce Accounts Receivable balances by generating better cashflow from the sales relationship. Reducing the complexity of key processes also lowers overheads and improves customer satisfaction and retention.

The Customer Value Group’s approach is sector and language specific, highly flexible and locally tailored to customer needs. Compatible with existing ERP, legacy systems and data sources, the methods employ internationally recognised best-practice. The benefits are significant, demonstrable and long-term, simultaneously reducing Accounts Receivable balances while building better customer relationships, leading to genuine Customer Value.

We provide our clients with:

- Segmentation of customer base by key criteria (e.g. size, risk level)

- Application of credit, collection and dispute policies to each segment

- Dynamic credit limit calculation based on payment behaviour and business volumes

- Automatic generation of payment reminder letters and prioritised tasks such as telephone reminders and follow up calls

- Customer query management and dispute action by segment

- Reporting performance targeting and tracking

- Sophisticated management reporting

We help our clients reduce DSOs and overdues, focus on proactive chasing of current debt, improve customer relationships through early focus on service issues and reduce process complexity and cost.